That means servicers wouldn’t be able to start foreclosure proceedings against a homeowner until at least January 1, 2022. It would last through December 31, 2021, starting from the rule’s effective date. There would also be certain situations when servicers could not charge fees, interest, or even past late fees during these modifications.įinally - and this is the big one - the rule would institute a “temporary COVID-19 pre-foreclosure review period,” during which servicers could not initiate foreclosure notices or filings. The rule would also allow servicers to offer loan modifications - including term extensions and payment deferrals - with less documentation for borrowers exiting forbearance. The goal is to help homeowners exit forbearance smoothly and resume mortgage payments in a way they can afford. This means mortgage loan servicers need to make ‘live contact’ (a phone call, for example) and provide borrowers with loss mitigation options before their forbearance period ends.

The CFPB’s proposed rule would impose a number of new protections for homeowners, the first being what it calls “early intervention live contact.” What the new foreclosure rule means for homeowners Here’s what you need to know about the proposal in its current state - and what it might mean for borrowers. It would also allow for streamlined loan modifications to help post-forbearance homeowners get back on their feet.įor now, the rule is still in the works, so things could change. The rule - which the CFPB says would benefit both underwater homeowners and mortgage servicers - would prohibit servicers from initiating the foreclosure process until after December 31 of this year.

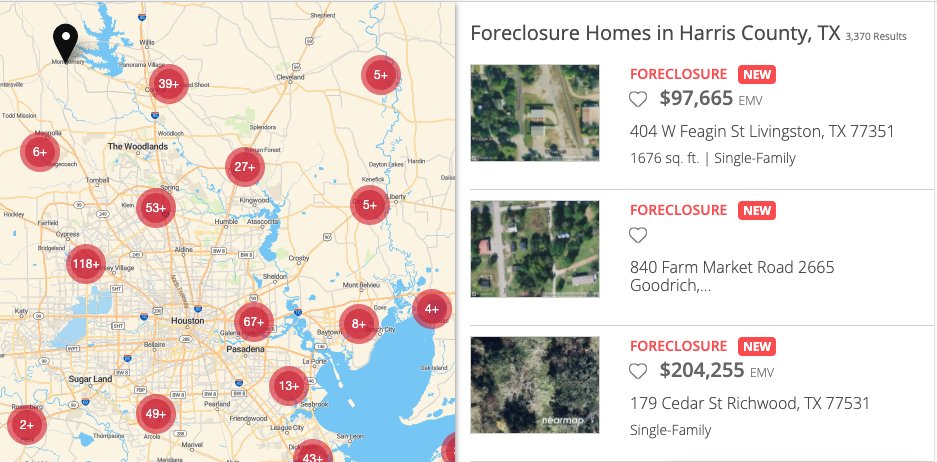

Fannie mae foreclosures texas plus#

Without knowledge of forbearance, a closing could be hindered if the payoff comes in higher than expected because it includes the payments that were not made during the agreement period, plus interest and fees associated with the agreement.Ap4 min read Foreclosure moratoriums could be extendedįoreclosures may be banned until 2022 if a new rule from the Consumer Financial Protection Bureau goes through. With forbearance, there may not be any documents recorded of public record to indicate the property owner entered into a forbearance agreement. It is estimated that nearly 3 million mortgages nationally are currently under forbearance. When entering into a residential real estate transaction, it is imperative that the seller is asked early in the process if they have entered into forbearance. How the extension affects title companies and real estate transactions The Biden administration states today’s extension will benefit 2.7 million homeowners enrolled in the mortgage forbearance program, and 11 million government-backed mortgages remain eligible for this assistance.

Fannie mae foreclosures texas mac#

These provisions apply to homeowners with government-backed mortgages, which account for about 70% of all mortgages in the United States and include loans from Fannie Mae and Freddie Mac as well as loans insured by the Federal Housing Administration. It’s key to understand that forbearance isn’t the same as forgiveness: Interest will continue to accrue on the mortgages during this period, and all costs will have to be repaid after the forbearance period ends (however, lenders are not allowed to ask for all of the skipped payments in one lump sum). Details of forbearance and foreclosure moratorium

Homeowners who entered forbearance on or before June 30, 2020, will be granted up to six months of additional mortgage payment forbearance in three-month increments. The protections extend the current foreclosure moratorium for homeowners through June 30, 2021, and extends the enrollment window for mortgage payment forbearance until June 30, 2021. The original order, enacted by President Trump in March 2020, offers protection to homeowners with federally-backed mortgages. The federal government extended the moratorium on foreclosures and mortgage payment forbearance until June. Families faced with financial uncertainty got some good news on Tuesday.

0 kommentar(er)

0 kommentar(er)